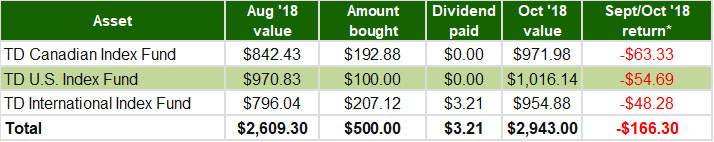

Rrsp Maximum 2018

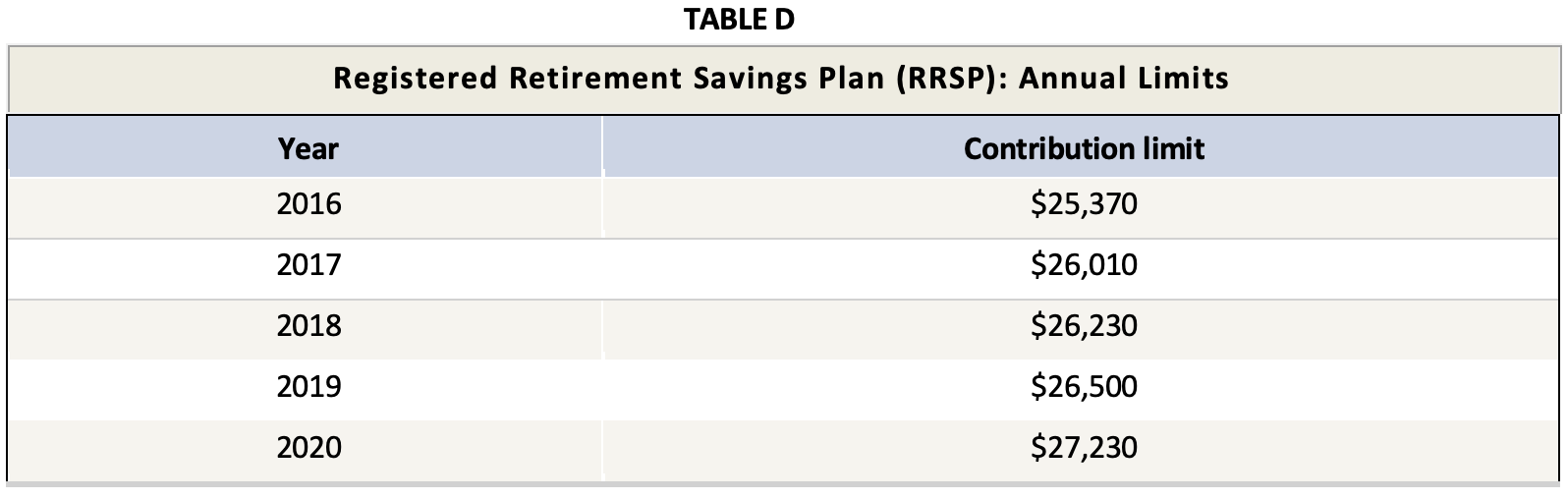

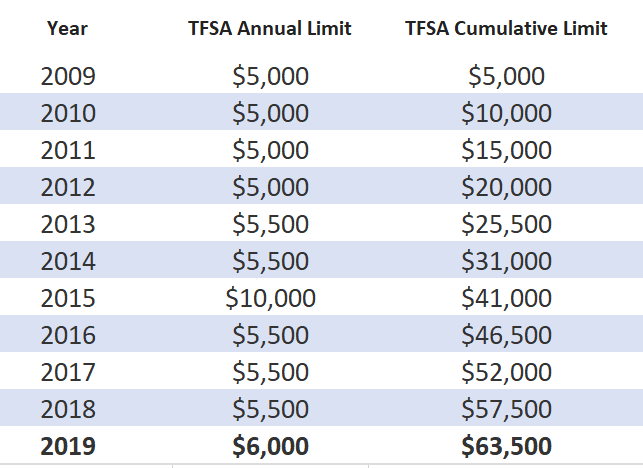

Contribution year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 please select an item.

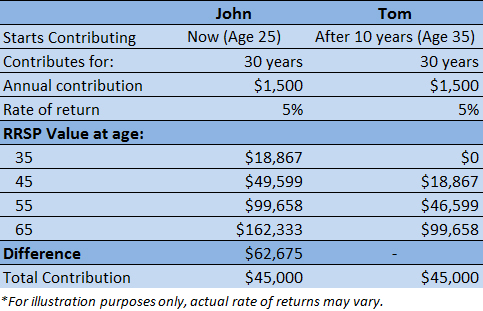

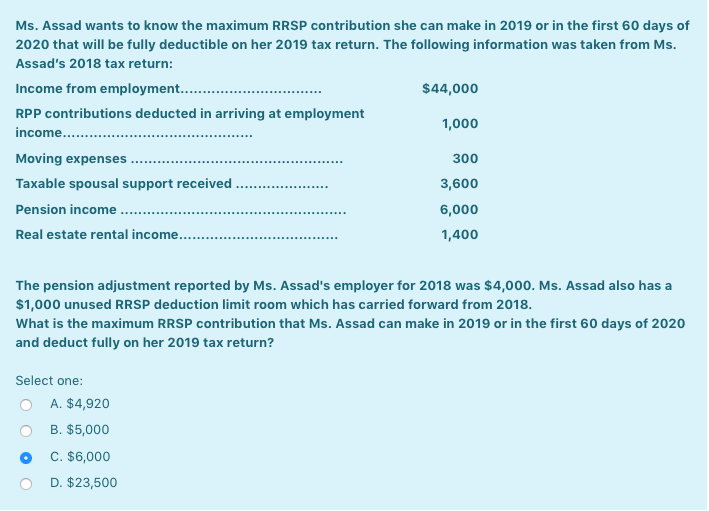

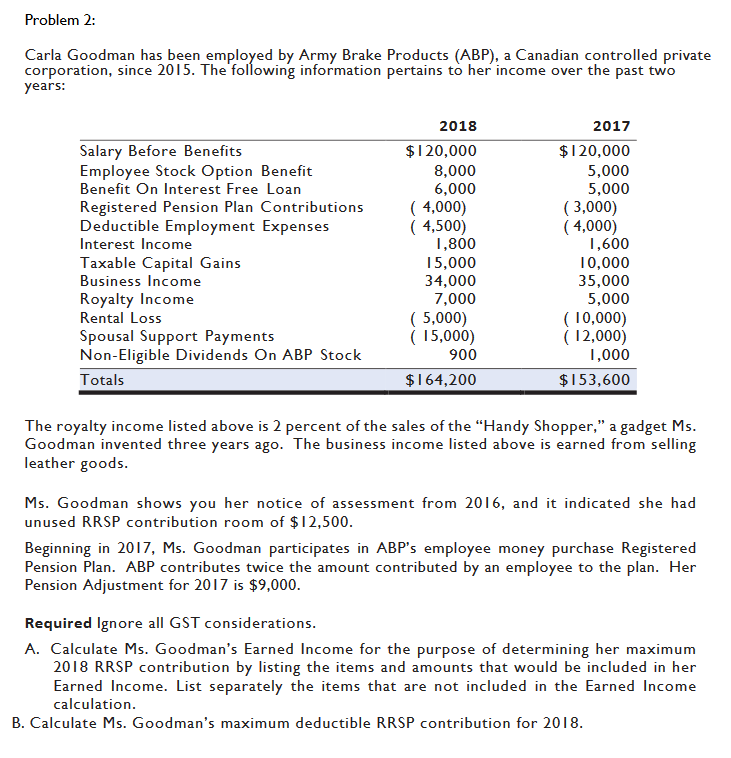

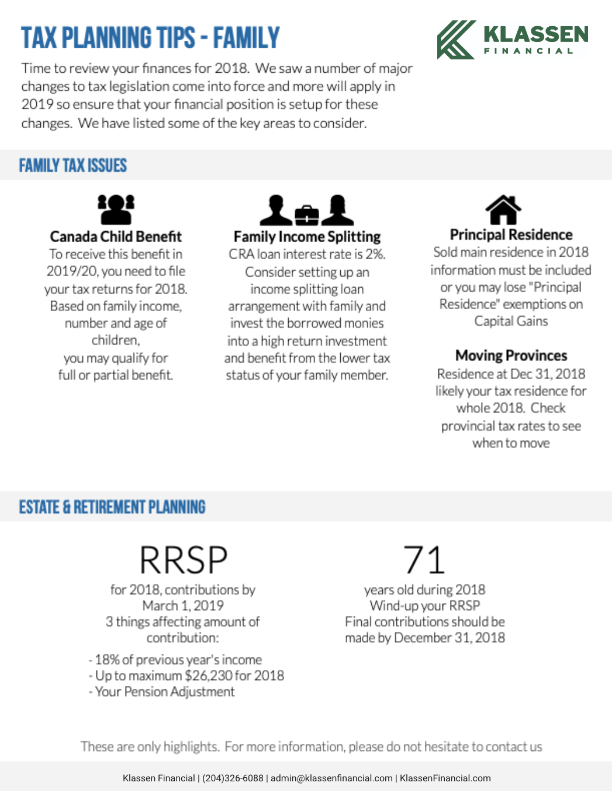

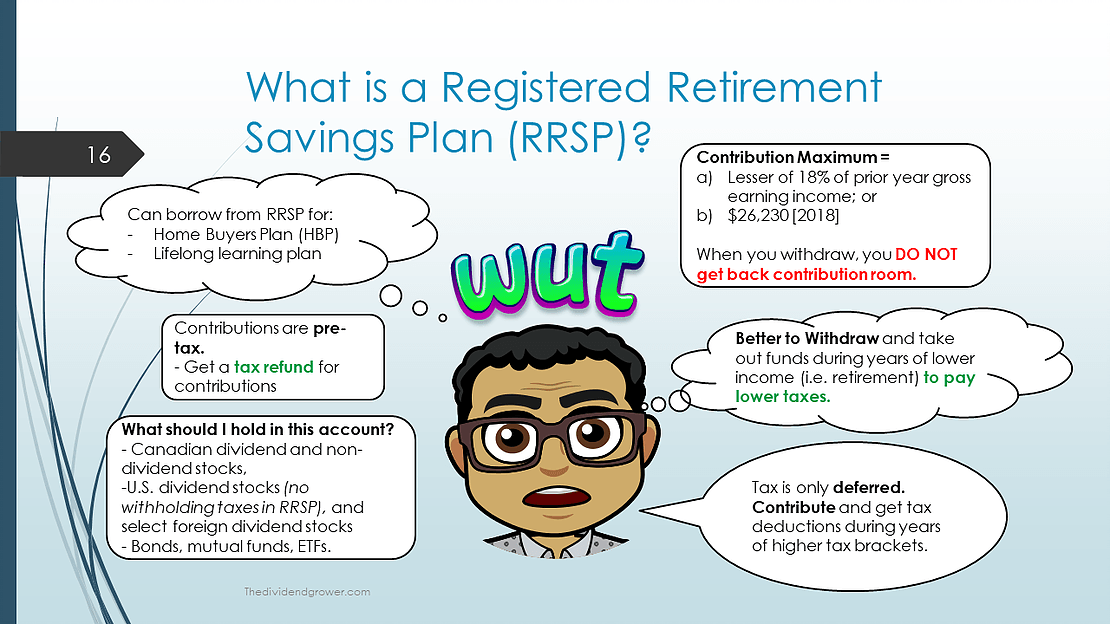

Rrsp maximum 2018. For 2017 that s. 18 of your earned income from the previous tax year. Maximum amount deductible rrsp pension adjustment pa 2017 pension adjustment reversal par for 2018 2017 unused rrsp amount deductions past services pension adjustment for 2018. For example if you earned 60 000 in 2019 your rrsp deduction limit is 18 x 60 000 10 800.

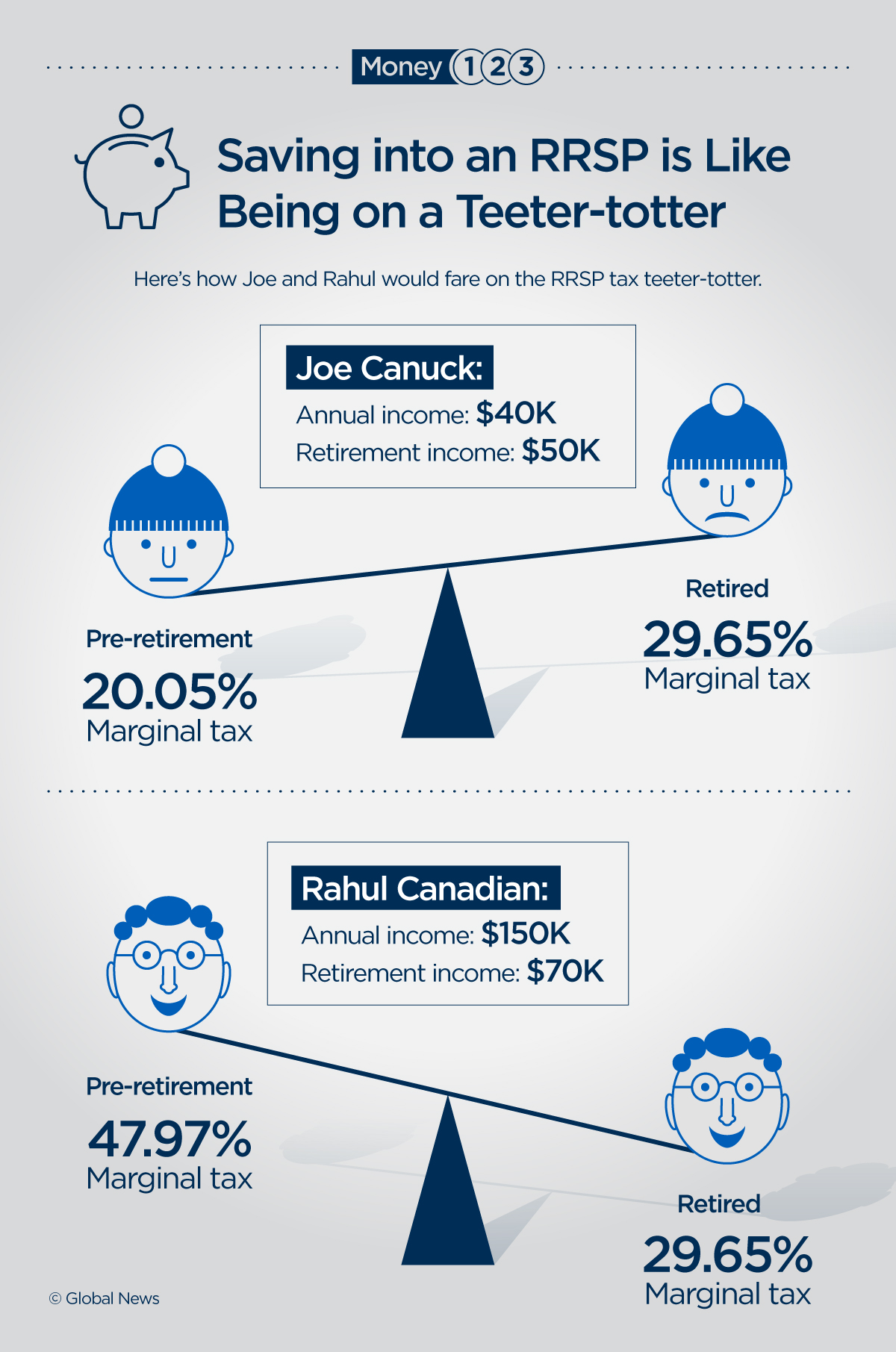

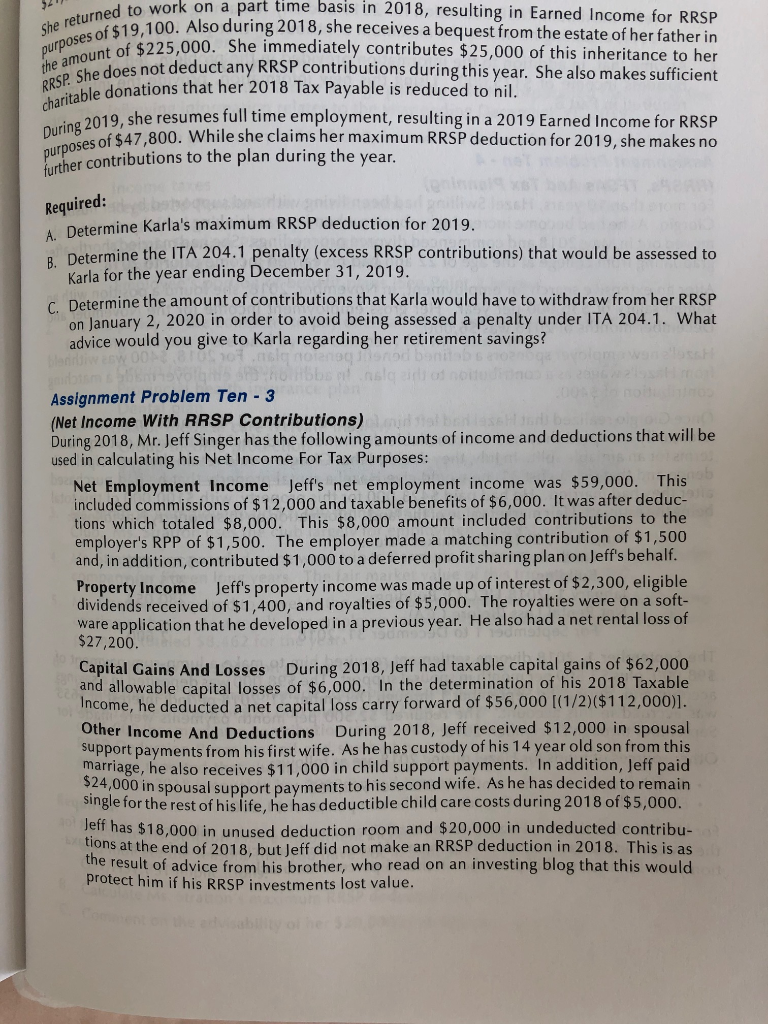

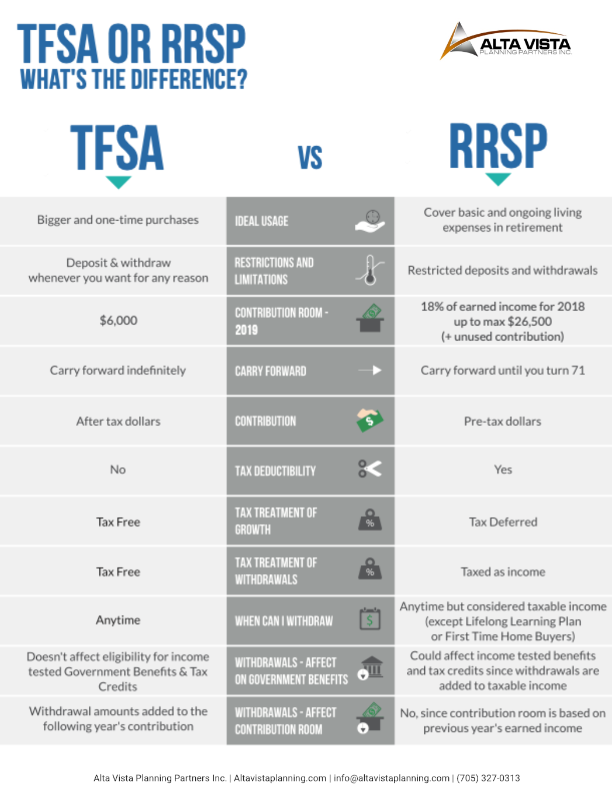

You may contribute to your rrsp until december 31 of the year in which you reach age 71. The maximum you can save into an rrsp every year is 18 per cent of your pre tax earned income from the previous year up to a ceiling that gets bumped up a bit every year. Earned income x maximum rate allowable for rrsp 18 100 maximum amount deductible rrsp take the lower of the previous calculation and rrsp deductible limit for 2018. Form t1028 your rrsp information for 2019.

The amount of rrsp contributions that you can deduct for 2018 is based on your 2018 rrsp deduction limit which appears on your latest notice of assessment or notice of reassessment or on a t1028. How is your rrsp limit calculated. This is less than the maximum deduction limit. For most people earned income for rrsp purposes is.

The rrsp deduction limit for the 2019 tax year is 18 of a taxpayer s pre tax earned income for 2019 or 26 500 whichever is less. Use the following rrsp contribution calculator to determine your maximum rrsp contribution. Mp db rrsp dpsp and tfsa limits and the ympe these tables outline the annual money purchase mp defined benefit db registered retirement savings plan rrsp deferred profit sharing plan dpsp and the tax free savings account tfsa limits as well as the year s maximum pensionable earnings ympe. Cra may send you a form t1028 if there are any changes to your rrsp deduction limit since your last assessment.

The 2019 2020 deduction limit explained.